Tax bills due date extended again

Published 12:20 pm Wednesday, January 10, 2018

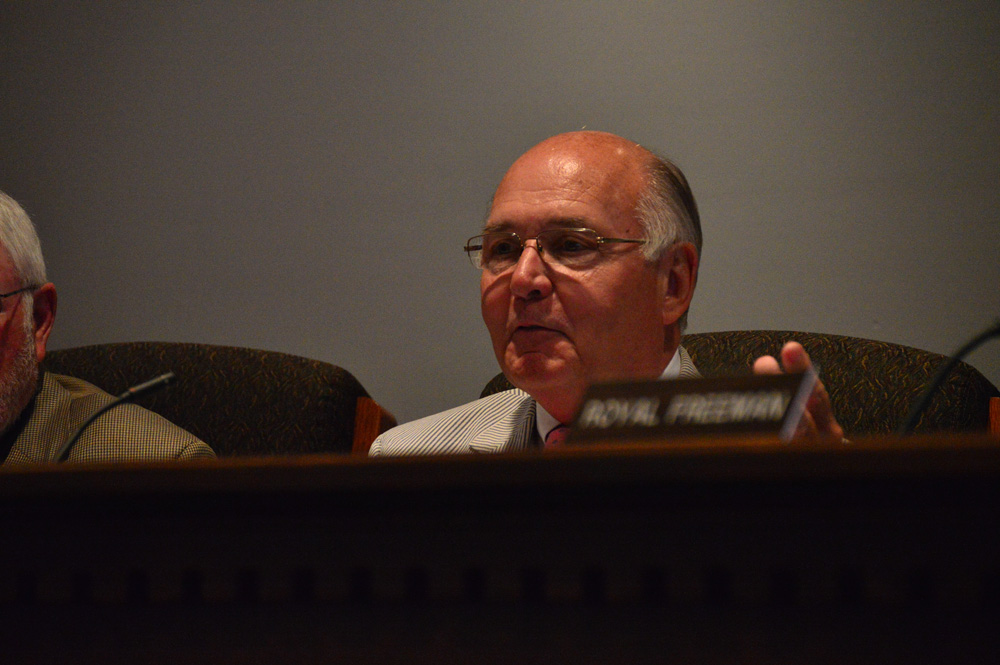

- County Administrator R.B. Clark discussed changes in the board’s budget procedure regarding “capital expenditures” during Monday’s public hearing.

The deadline to pay real estate and personal property tax bills in Charlotte County has been extended to Jan. 31, the new last day to pay before penalties are assessed.

On Tuesday at its monthly meeting, the Charlotte County Board of Supervisors approved a motion to not charge any penalties on payments made before the end of January.

While the bills have already been mailed, Charlotte County Administrator R.B. Clark said, “This board indicated they wanted to work with the treasurer about this penalty and so forth on paying the taxes because of the glitch and problems with the software.”

He said the bills currently reflect a Jan. 19 due date.

In light of the problems, he proposed the board not charge any penalties of interest if citizens pay before the end of January.

Charlotte County Treasurer Patricia Berkeley said in a previous interview that citizens were welcome to come in the office to pay, but she suggested early payers still compare their bills once received to ensure accuracy.

She said she has copies of the bills available at the Treasurer’s Office that can be accessed.

With the original due date being Dec. 5, previously Berkeley said an extension of up to 90 days was allowed.

According to the county’s website, county taxes are billed twice each fiscal year. Taxes are typically due Dec. 5 for the first half of the fiscal year and June 5 for the remainder of the year.

Real estate and personal property taxes were previously due Jan. 19 before any penalties would be placed.

“We will be monitoring the checks and postmark date,” said Berkeley in a previous interview.

According to the county’s website, the county’s new online tax portal has been implemented.

Berkeley previously said they are working to get the website up and running in the next week or two.

The county’s website said a new online tax payment option will soon be added to the site.

The real estate and personal property tax bills delay stemmed from a conversion to an updated software program called Breeze.

“It’s been a lot more involved than we ever anticipated,” Berkeley said in a previous interview.

She said the tax bills system was updated in May.

She noted the county has been using the same company, RDA systems, since 1994.

“This conversion has been totally different,” she said at that time. “… We’ve experienced a lot of delays.”

In addition, she had said the staff at the Commissioner of Revenue’s Office had been working overtime in order to get all the information ready to come to the Treasurer’s Office.

According to information from RDA’s website, “We have capitalized on 36-plus years of experience working with local government and K12 school districts. Breeze offers a brand new state of the art system to simplify and streamline revenue management.”

Currently, Charlotte County is the only locality using the updated system.